Current Ratio Definition, Explanation, Formula, Example and Interpretation

In other words, the current ratio is a good indicator of your company’s ability to cover all of your pressing debt obligations with the cash and short-term assets you have on hand. invoice template for excel It’s one of the ways to measure the solvency and overall financial health of your company. Let’s say a business has $150,000 in current assets and $100,00 in current liabilities.

- Companies that are seasonal or have seasonal cycles in either product production or accounts receivable can look very poor when it comes to the current ratio at certain times of the year and very good at others.

- But a higher current ratio is NOT necessarily always a positive sign — instead, a ratio in excess of 3.0x can result from a company accumulating current assets on its balance sheet (e.g. cannot sell inventory to customers).

- Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

- In other words, for every $1 of current liability, the company has $2.32 of current assets available to pay for it.

- Banks would prefer a current ratio of at least 1 or 2, so that all the current liabilities would be covered by the current assets.

Submit to get your question answered.

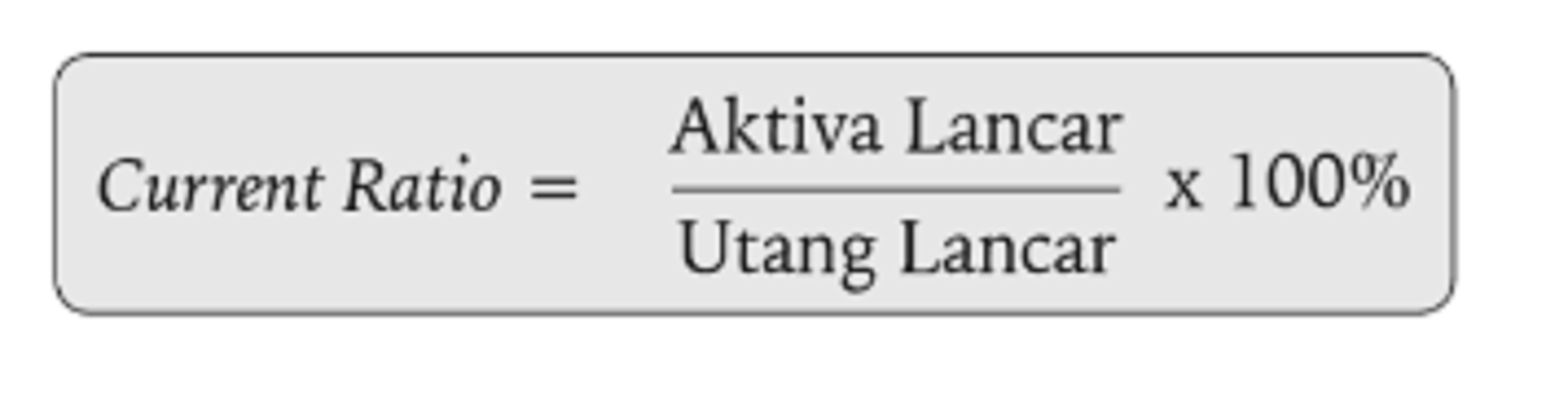

In this scenario, the company would have a current ratio of 1.5, calculated by dividing its current assets ($150,000) by its current liabilities ($100,000). The current ratio is used to evaluate a company’s ability to pay its short-term obligations, such as accounts payable and wages. The higher the result, the stronger the financial position of the company.

The role of the current ratio in financial analysis

Ask a question about your financial situation providing as much detail as possible. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

How does Working Capital relate to liquidity?

Explore opportunities for investing in Databricks, and the ins and outs of this tech company. Average values for the ratio you can find in our industry benchmarking reference book – Current ratio. To give you an idea of sector ratios, we have picked up the US automobile sector. Learn the right way to pay yourself, depending on your business structure. This includes all the goods and materials a business has stored for future use, like raw materials, unfinished parts, and unsold stock on shelves.

Changes in the current ratio over time can often offer a clearer picture of a company’s finances. A company that seems to have an acceptable current ratio could be trending toward a situation in which it will struggle to pay its bills. Conversely, a company that may appear to be struggling now could be making good progress toward a healthier current ratio. For example, a normal cycle for the company’s collections and payment processes may lead to a high current ratio as payments are received, but a low current ratio as those collections ebb. Calculating the current ratio at just one point in time could indicate that the company can’t cover all of its current debts, but it doesn’t necessarily mean that it won’t be able to when the payments are due.

That means the company in question can pay its current liabilities one and a half times with its current assets. Within the current ratio, the assets and liabilities considered often have a timeframe. For example, liabilities in this ratio are usually due within one year. On the other hand, current assets in this formula are resources the company will use up or liquefy (converted to cash) within one year.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Current assets refers to the sum of all assets that will be used or turned to cash in the next year. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Another ratio interested parties can use to evaluate a company’s liquidity is the cash ratio. The cash ratio is like the current ratio, except it only considers a company’s most liquid assets in evaluating its liquidity. Another ratio, which is similar to the current ratio and can be used as a liquidity measure, is the quick ratio. Both give a view of a company’s ability to meet its current obligations should they become due, though they do so with different time frames in mind. You calculate your business’s overall current ratio by dividing your current assets by your current liabilities.